The Growing Popularity of Offshore Trustee Arrangements in Global Finance

The Growing Popularity of Offshore Trustee Arrangements in Global Finance

Blog Article

Reasons You May Need an Offshore Trustee for Your Financial Preparation

In today's complicated monetary landscape, the duty of an overseas trustee can be essential for individuals seeking to boost their economic planning strategies. The subtleties of worldwide guidelines and the prospective benefits they offer warrant a better assessment to completely appreciate their impact on your economic method.

Possession Protection Methods

Property security techniques are important tools for guarding riches against potential lawful insurance claims and financial responsibilities. These methods are specifically crucial for people and companies facing raised exposure to suits, creditors, or unpredicted monetary setbacks. By utilizing reliable property defense actions, one can maintain possessions from being confiscated or accessed in case of a legal dispute.

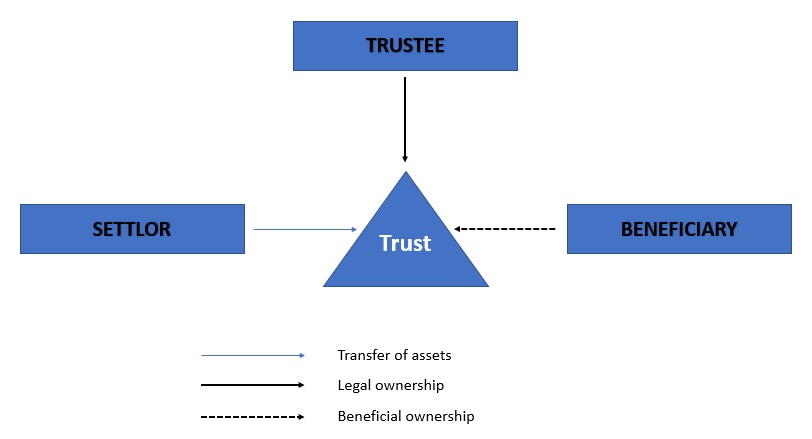

Typical strategies include the facility of limited obligation entities, such as Limited Obligation Firms (LLCs) or corporations, which can protect individual assets from business-related liabilities - offshore trustee. Furthermore, making use of irrevocable depends on can provide a robust layer of security, as possessions moved right into these trusts are typically exempt to financial institution insurance claims

In addition, diversifying investments throughout territories can minimize risks related to any single legal system. Offshore depends on, specifically, offer tactical benefits by positioning assets beyond the reach of domestic legal insurance claims while following global legislations.

Inevitably, a well-structured possession security strategy is essential to economic planning, enabling businesses and people to secure their wealth while preserving compliance with appropriate policies. Involving with legal and monetary professionals is suggested to customize strategies that best fit private conditions.

Boosted Privacy and Discretion

Offshore jurisdictions frequently have rigorous personal privacy regulations that secure customers' identities and economic tasks from public scrutiny. This implies that sensitive economic information can be taken care of discreetly, lowering the threat of direct exposure that may occur in more transparent territories. By utilizing an offshore trustee, clients can distance their properties from public documents, ensuring that their financial events remain confidential.

Moreover, overseas frameworks can assist in privacy in possession, enabling people to perform deals without disclosing personal information. This can be specifically valuable for high-net-worth individuals or those in sectors where privacy is vital.

Additionally, overseas trustees are usually accustomed to managing global customers, providing know-how in browsing complicated privacy regulations. offshore trustee. Generally, boosted personal privacy and privacy not only safeguard specific interests yet additionally allow for more tactical financial planning in an increasingly clear globe

Tax Obligation Optimization Opportunities

Utilizing an overseas trustee not just enhances privacy and confidentiality yet additionally opens significant tax obligation optimization opportunities. By establishing an overseas trust fund, people can frequently gain from positive tax jurisdictions, which might offer reduced tax prices or perhaps tax obligation exceptions on particular earnings types. This can be particularly beneficial for high-net-worth individuals and entrepreneur seeking to reduce their worldwide tax liabilities.

Offshore trust funds can assist in the calculated allotment of possessions, permitting for tax-efficient circulations to beneficiaries. Different territories may have unique tax treaties that can additionally decrease the total tax obligation worry on income produced from investments held within the depend on. By leveraging the expertise of an overseas trustee, clients can navigate intricate tax guidelines more properly, ensuring conformity while making the most of tax obligation benefits.

In addition, offshore counts on can provide opportunities for funding gains tax deferral, using a method to grow wealth without prompt tax effects. The capability to structure financial investments and income streams through an overseas entity enables customized monetary planning, aligning with specific tax obligation methods and long-lasting financial objectives. Inevitably, an offshore trustee can be a crucial element browse around here in optimizing tax effectiveness in a thorough financial plan.

Sequence Planning Benefits

Numerous individuals neglect the crucial duty that offshore trust funds can play in efficient sequence preparation. Offshore trusts provide a critical mechanism for moving wealth throughout generations while ensuring that possessions are shielded from prospective lenders and lawful disputes. By positioning possessions in an overseas trust fund, individuals can assign beneficiaries and synopsis details problems for possession circulation, thus preserving control over exactly how their wealth is managed long after they are gone.

In addition, overseas trust funds can minimize inheritance tax and lower probate issues. Considering that these depends on are usually established in jurisdictions with beneficial tax obligation policies, they can decrease tax liabilities, enabling more riches to be protected for recipients. Additionally, the privacy afforded by overseas counts on can protect the details of one's estate from public examination, safeguarding family members interests.

Navigating International Laws

Effective succession planning with overseas depends on requires a thorough understanding of international policies. As monetary landscapes come to be increasingly globalized, individuals seeking to protect their assets have to navigate an intricate internet of laws controling offshore structures. Each jurisdiction has its very own collection of laws relating to property coverage, security, and tax demands, which can differ substantially.

When engaging an offshore trustee, it is essential to make certain that they are skilled in both the laws of the jurisdiction where the count on is developed and the policies of the recipient's home country. This twin understanding helps reduce dangers related to conformity failures, which could result in serious fines or unexpected tax responsibilities.

Furthermore, worldwide guidelines, such as the Typical Coverage Standard (CRS) and Foreign Account Tax Obligation Conformity Act (FATCA), this hyperlink impose rigorous coverage commitments on economic organizations and trustees. Selecting a respectable offshore trustee who has the requisite knowledge in worldwide policies is important for effective financial preparation and asset protection.

Final Thought

In conclusion, the involvement of an overseas trustee provides many advantages for efficient monetary preparation. The application of offshore trustees inevitably contributes to the long-term stability and development of monetary portfolios in an increasingly complex global landscape.

In today's complicated financial landscape, the duty of an offshore trustee can be critical for people looking for to enhance their financial planning strategies. By making use of an offshore trustee, customers can distance their properties from public documents, making certain that their monetary events stay confidential.

The ability to framework financial investments and earnings streams informative post with an offshore entity allows for tailored financial preparation, aligning with specific tax methods and long-term financial objectives. As monetary landscapes become progressively globalized, people looking for to secure their possessions must browse a complex internet of legislations governing overseas structures. Picking a trusted offshore trustee that has the requisite expertise in international laws is necessary for efficient financial preparation and possession security.

Report this page